Here is the same sample above that now has some random information entered into it with my quick (but messy!) handwriting. This is to show you how easy it is to keep a spreadsheet to track the money. Exact measurements are not a requirement for keeping a cash book spreadsheet. In this case, cash is a lose term covering not only papermoney and coins but also cheques/checks, direct credits, electronic transferpayments, and so on. Discount allowed is an expense, and discount received is an income of the business. Angela Boxwell, MAAT, is an accounting and finance expert with over 30 years of experience.

Where should we send your answer?

The importance of keeping a cash book cannot be overstated for business success. Additionally, businesses should be wary of the potential pitfalls mentioned above, particularly if they are just starting. Keep your cash book balanced and you’ll never have to balance on a tightrope of financial ruin. Just ask the lucky recipient of a stack of bills in the payments made by cash section of the cash book.

What is the approximate value of your cash savings and other investments?

In cases where there may be trouble detecting any potential inaccuracies, get professional assistance to assure your accounts remain balanced. Looks like the triple column cash book is where the finances get serious, it’s like the accountant’s version of depreciation tax shield calculation a three-layer cake. Under this system, the petty cashier is given a lump sum to meet petty expenses. When the whole amount of petty cash is spent, the petty cashier submits the account to the chief cashier who again pays a lump sum to the petty cashier.

Petty Cash Book Template

- Entries in the cash book are posted then to the corresponding general ledger.

- A double-column cash book, also called a two-column cash book, records both cash and bank transactions.

- Consequently, this cash book has given rise to the concept of contra entries, commonly denoted as ‘C’ in the cash book.

- Instead, residual income valuation can be effective because it focuses on accounting-based metrics like book value and net income.

- A passbook, on the other hand, is typically kept by the bank and provided to the customer.

- The most popular formats are the two and three column formats as detailed below.

All items on the debit side of the cash book are posted to the credit of respective accounts in the ledger. All items on the credit side of the cash book are posted to the debit of respective accounts in the ledger. In a three column cash book, three columns are provided for the amounts on each side.

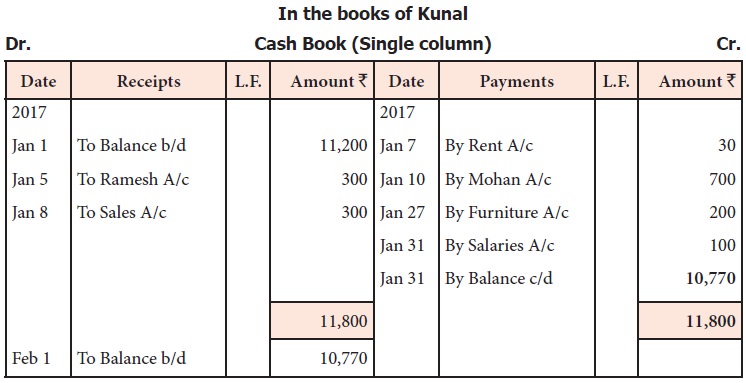

The transactions done on credit are not recorded while preparing the single-column cash–book. This is because all cash receipts and payments are recorded in a cash book. Some businesses maintain cash books instead of cash receipts journals and cash payments journals. The format of a double-column cash book given above has six columns on both debit and credit sides.

Transactions involving cash inflows or outflows, along with details such as dates, amounts, and relevant accounts involved, all get recorded into the ledger. The two columns of this record allow for the tracking of both incoming and outgoing money through the business. The left column deals with all cash inflows, while the right column tracks all cash outflows, making it much simpler to review the company’s net cash gain or loss regularly. A book of records showing the transactions related to cash is called a ‘Basic Cash Book’. The first type of Basic Cash Book is known as the ‘Single Column Cash Book’, which denotes only a single column for each entry.

The difference between the sum of the debit items and the sum of the credit items represents the balance of the petty cash in hand. A tech start-up that is reinvesting heavily for growth may have negative or inconsistent cash flows, making traditional DCF valuation difficult. Residual income valuation, which focuses on book value and net income, can provide an alternative measure of value. Residual income valuation estimates a company’s value based on the income it generates over and above the required return on equity. The required return is the minimum rate of return demanded by investors, reflecting the opportunity cost of investing in that equity.

A Cash Book is a bookkeeping document that enables the recording of all cash transactions. The Triple Column Cash Book is one type of cash book used to maintain the daily cash inflow and outflow in detail. The single-column cash book is the easiest type of cash book to use.

Record the following transactions in an analytical petty cash book for the month of January 2019. If they record petty expenses in the main cash book, then both the chief cashier and the main cash book will be overburdened. It acts as a journal or book of prime entry because all cash transactions are recorded in it as and when they take place.