If they exceed the initial relevant range, the fixed costs would increase to \(\$400\) for nine to sixteen passengers. The following are the steps to calculate the contribution margin for your business. And to understand each of the steps, let’s consider the above-mentioned Dobson example. Thus, the total manufacturing cost for producing 1000 packets of bread comes out to be as follows.

Contribution Margin Per Unit

We may earn a commission when you click on a link or make a purchase through the links on our site. All of our content is based on objective analysis, and the opinions are our own. Thus, at the 5,000 unit level, there is a profit of $20,000 (2,000 units above break-even point x $10). Variable costs tend to represent expenses such as materials, shipping, and marketing, Companies can reduce these costs by identifying alternatives, such as using cheaper materials or alternative shipping providers. Find out what a contribution margin is, why it is important, and how to calculate it. Discover the next generation of strategies and solutions to streamline, simplify, and transform finance operations.

What is the Contribution Margin Ratio?

Crucial to understanding contribution margin are fixed costs and variable costs. A contribution margin represents the money made by selling a product or unit after subtracting the variable costs to run your business. The Contribution Margin is the incremental profit earned on each unit of product sold, calculated by subtracting direct variable costs from revenue. This means that the production of grapple grommets produce enough revenue to cover the fixed costs and still leave Casey with a profit of $45,000 at the end of the year. The contribution margin represents the revenue that a company gains by selling each additional unit of a product or good.

Analysis and Interpretation

The contribution margin supports management in strategic decisions, such as the introduction of new products, the discontinuation of unprofitable products or the optimization of the production program. As you can see, contribution margin is an important metric to calculate and keep in mind when determining whether to make or provide a specific product or service. More importantly, your company’s contribution margin can tell you how much profit potential a product has after accounting for specific costs. A low margin typically means that the company, product line, or department isn’t that profitable.

Instead of doing contribution margin analyses on whole product lines, it is also helpful to find out just how much every unit sold is bringing into the business. The Contribution Margin Calculator is an online tool that allows you to calculate contribution margin. You can use the contribution margin calculator using either actual units sold or the projected units to be sold. In the Dobson Books Company example, the contribution margin for selling $200,000 worth of books was $120,000. Now, let’s try to understand the contribution margin per unit with the help of an example.

Formula For Contribution Margin

When the contribution margin is expressed as a percentage of sales, it is called the contribution margin ratio or profit-volume ratio (P/V ratio). A subcategory of fixed costs is overhead costs that are allocated in GAAP accounting to inventory and cost of goods sold. This allocation of fixed overhead isn’t done for internal analysis of contribution margin. But what is considered “good” largely can depend on your industry. For example, in sectors with high fixed costs, such as those with hefty capital investments or sizable research and development expenditures, a higher contribution margin ratio may be needed to achieve viability.

- Some companies do issue contribution margin income statements that split variable and fixed costs, but this isn’t common.

- Profit, on the other hand, is the amount that remains after both the variable and fixed costs have been fully covered.

- Knowing your company’s variable vs fixed costs helps you make informed product and pricing decisions with contribution margin and perform break-even analysis.

- Next, the CM ratio can be calculated by dividing the amount from the prior step by the price per unit.

- Let’s now apply these behaviors to the concept of contribution margin.

You will also learn how to plan for changes in selling price or costs, whether a single product, multiple products, or services are involved. Therefore, the unit contribution margin (selling price per unit minus variable costs per unit) is $3.05. The company’s contribution margin of $3.05 will cover fixed costs of $2.33, contributing xeros growth strategy $0.72 to profits. The contribution margin ratio is just one of many important financial metrics used for making better informed business decisions. The ratio can help businesses choose a pricing strategy that makes sure sales cover variable costs, with enough left over to contribute to both fixed expenses and profits.

An increase like this will have rippling effects as production increases. Management must be careful and analyze why CM is low before making any decisions about closing an unprofitable department or discontinuing a product, as things could change in the near future. Investors examine contribution margins to determine if a company is using its revenue effectively. A high contribution margin indicates that a company tends to bring in more money than it spends. Say a machine for manufacturing ink pens comes at a cost of $10,000. Let’s look at an example of how to use the contribution margin ratio formula in practice.

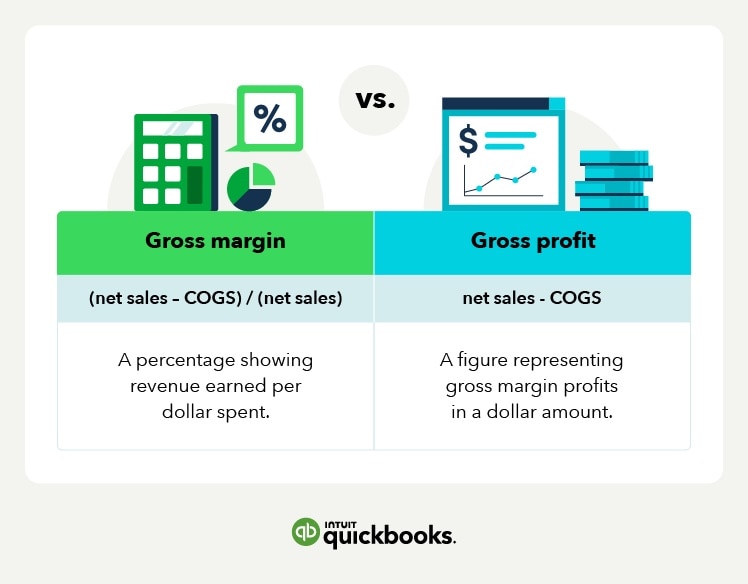

Gross margin is synonymous with gross profit margin and includes only revenue and direct production costs. It does not include operating expenses such as sales, marketing costs, taxes, or loan interest. The metric uses direct labor and direct materials costs, not administrative costs for operating the corporate office. The contribution margin is computed as the selling price per unit, minus the variable cost per unit. Also known as dollar contribution per unit, the measure indicates how a particular product contributes to the overall profit of the company.

Contribution margin 2 is calculated by deducting the area-specific fixed costs from CM1, i.e. the fixed costs that can be directly allocated to a specific product area or product group. Contribution margin 3 is calculated by deducting from CM2 the other fixed costs that are incurred at company level and cannot be directly allocated to a specific area. Using this formula, the contribution margin can be calculated for total revenue or for revenue per unit. For instance, if you sell a product for $100 and the unit variable cost is $40, then using the formula, the unit contribution margin for your product is $60 ($100-$40). This $60 represents your product’s contribution to covering your fixed costs (rent, salaries, utilities) and generating a profit.