As another step, you can compute the cash breakeven point using cash-based variable costs and fixed costs. Compare the lines for determining accrual basis breakeven and cash breakeven on a graph showing different volume levels. Cost accountants, FP&A analysts, and the company’s management team should use the contribution margin formula.

How is contribution margin calculated?

Variable Costs depend on the amount of production that your business generates. Accordingly, these costs increase with the increase in the level of your production and vice-versa. This means the higher the contribution, the more is the increase in profit or reduction of loss. In other words, your contribution margin increases with the sale of each of your products. Overall, the contribution margin plays a key role in understanding a company’s economic situation, making informed business decisions and ensuring long-term competitiveness. It is important to note that the contribution margin should not be considered in isolation.

Variable Costs

Furthermore, this ratio is also useful in determining the pricing of your products and the impact on profits due to change in sales. Accordingly, in the Dobson Books Company example, the contribution margin ratio was as follows. This is because the contribution margin ratio lets you know the proportion of profit that your business generates at a given level of output. Thus, the contribution margin ratio expresses the relationship between the change in your sales volume and profit.

What is the difference between the contribution margin ratio and contribution margin per unit?

So, it is an important financial ratio to examine the effectiveness of your business operations. Now, this situation can change when your level of production increases. As mentioned above, the per unit variable cost decreases with the increase in the level of production. Sales revenue refers to the total income your business generates as a result of selling goods or services.

In Cost-Volume-Profit Analysis, where it simplifies calculation of net income and, especially, break-even analysis. Soundarya Jayaraman is a Content Marketing Specialist at G2, focusing on cybersecurity. Formerly a reporter, Soundarya now covers the evolving cybersecurity landscape, how it affects businesses and individuals, and how technology can help. You can find her extensive writings on cloud security and zero-day attacks.

You can even calculate the contribution margin ratio, which expresses the contribution margin as a percentage of your revenue. Calculating the contribution margin for each product is one solution to business and accounting problems arising from not doing enough financial analysis. Calculating your contribution margin helps you find valuable business solutions through decision-support analysis. For League Recreation’s Product A, a premium baseball, the selling price per unit is $8.00. Calculate contribution margin for the overall business, for each product, and as a contribution margin ratio. Calculations with given assumptions follow in the Examples of Contribution Margin section.

To calculate this figure, you start by looking at a traditional income statement and recategorizing all costs as fixed or variable. This is not as straightforward as it sounds, because it’s not always clear which costs fall into each category. But going through this exercise will give you valuable information.

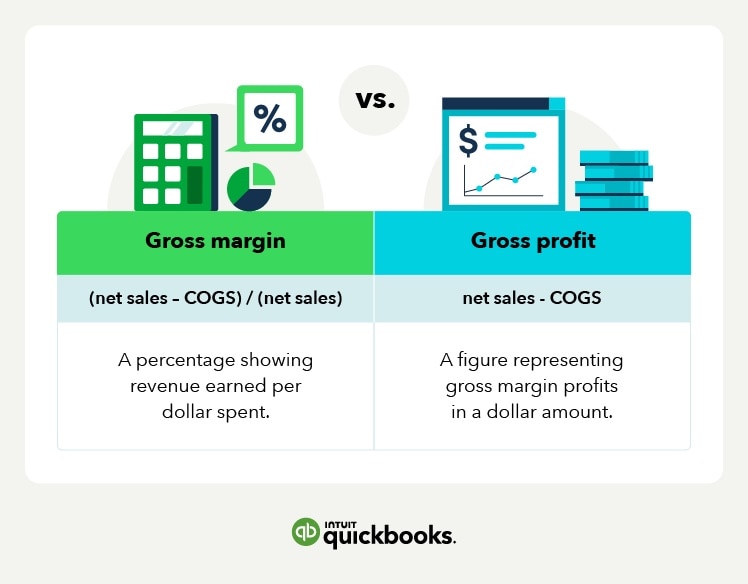

The gross margin shows how well a company generates revenue from direct costs such as direct labor and direct materials costs. Gross margin is calculated by deducting COGS from revenue, dividing the result by revenue, and multiplying by 100 to find a percentage. It appears that Beta would do well by emphasizing Line C in its product mix.

The companies that operate near peak operating efficiency are far more likely to obtain an economic moat, contributing toward the long-term generation of sustainable profits. For information pertaining to the registration status of 11 Financial, dividends payable definition + journal entry examples please contact the state securities regulators for those states in which 11 Financial maintains a registration filing. There is no definitive answer to this question, as it will vary depending on the specific business and its operating costs.

- Also, you can use the contribution per unit formula to determine the selling price of each umbrella.

- One packet of whole wheat bread requires $2 worth of raw material.

- At breakeven, variable and fixed costs are covered by the sales price, but no profit is generated.

After variable costs of a product are covered by sales, contribution margin begins to cover fixed costs. No, the contribution margin is not the same as the break-even point. Contribution margin 1 is the difference between the sales revenue and the variable costs of a product or service.